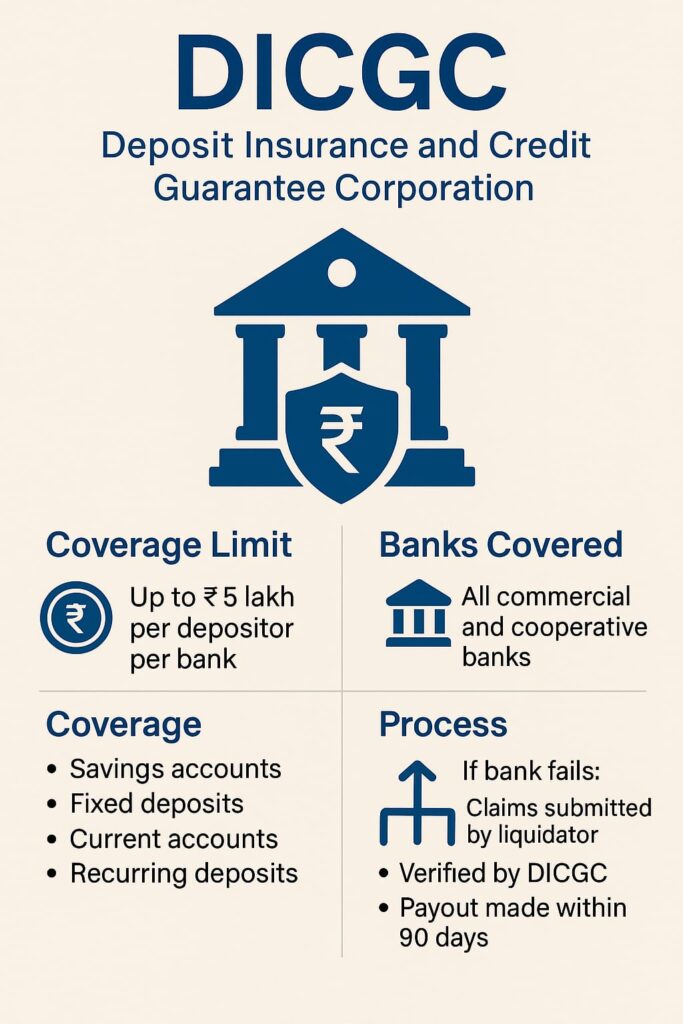

The Deposit Insurance and Credit Guarantee Corporation (DICGC) play a vital role in ensuring the safety of depositors’ money in India. Governed by the Reserve Bank of India (RBI), DICGC provides insurance cover to bank deposits, protecting account holders in case a bank fails. In this blog, we will explore how DICGC works, its coverage limits, and its importance in India’s financial system.

What is DICGC?

The DICGC is a wholly-owned subsidiary of the Reserve Bank of India. It was established under the Deposit Insurance and Credit Guarantee Corporation Act, 1961, with a key goal to insure bank deposits and offer credit guarantees for small borrowers. The corporation ensures that if a bank collapses, depositors will still receive a guaranteed amount from their deposits.

How Does DICGC Work?

DICGC collects a premium from banks and provides deposit insurance to their customers. Importantly, depositors do not need to pay anything. All insured banks pay the premium on behalf of their customers. If a bank gets liquidated or is unable to pay back depositors, DICGC steps in and compensates eligible depositors.

What Does DICGC Cover?

As per the current rules, DICGC insures deposits up to 5 lakhs per depositor per bank, including:

- Savings accounts

- Fixed deposits (FDs)

- Current accounts

- Recurring deposits (RDs)

This limit includes both principal and interest amount.

Example:

If you have 3 lakhs in savings and 1.5 lakhs in FD in the same bank, and the bank fails, DICGC will reimburse you the full 4.5 lakhs, as it is under the 5 lakhs limit.

What is not covered?

DICGC does not insure the following:

- Deposits of foreign governments

- Inter-bank deposits

- Government deposits

- Deposits from state cooperative banks in other states

- Any amount above 5 lakhs per individual per bank

So, if you have 7 lakhs in one bank and it fails, you will only get 5 lakhs under DICGC coverage.

Which Banks are covered by DICGC?

All commercial banks operating in India, including public sector banks, private banks, foreign banks, regional rural banks (RRBs), and cooperative banks, come under DICGC coverage.

Before opening a deposit, always ensure your bank is insured by DICGC. The bank must clearly mention this in its official communication and at branch offices.

How to Claim Insurance from DICGC?

If your bank fails:

- The liquidator will gather depositor data.

- DICGC will verify claims.

- Within 90 days, DICGC will release the insurance payout to the depositors via the liquidator or administrator.

As a depositor, you don’t need to file a claim directly. The process runs through the bank and DICGC’s internal coordination.

Why is DICGC Important?

DICGC plays a crucial role in maintaining public trust in the banking system. It ensures financial stability and protects small depositors, especially during times of economic stress. After a few major bank failures in India, the coverage limit was raised from 1 lakhs to 5 lakhs in 2020, giving more security to millions of account holders.

Tips to Maximize DICGC Coverage:

- Split large deposits across different banks

- Keep joint accounts to enhance coverage (each holder gets 5 lakhs)

- Stay updated with your bank’s DICGC status

Final Thoughts

DICGC acts as a safety net for depositors. In a country like India, where millions of people save their hard-earned money in banks, DICGC’s role becomes even more vital. With a maximum coverage of 5 lakhs per depositor per bank, it provides peace of mind and promotes financial inclusion.

Before depositing large sums, always check if the bank falls under DICGC coverage. Stay informed and smartly plans your savings to enjoy full protection.

For more information, please visit the website below.