The GST e-way bill plays a vital role in the transport of goods. If you move goods worth more than 50,000 from one place to another, you must generate an e-way bill. But what happens if you make a mistake or cancel the shipment? In such cases, you must cancel the e-way bill within a specific time frame. If you don’t, the buyer can still reject it.

What is an E-Way Bill?

An e-way bill is an electronic document required under GST for moving goods across states or within the same state. It contains details of the consignor, consignee, goods, and transporter. It helps the government track the movement of goods and prevents tax evasion.

Why Cancel an E-Way Bill?

You should cancel an e-way bill in the following cases:

- The supplier did not transport the goods.

- The order was cancelled by the buyer.

- There was a mistake in the bill (wrong GSTIN, discrepancy in the amount, etc.).

- The supplier generated a duplicate e-way bill.

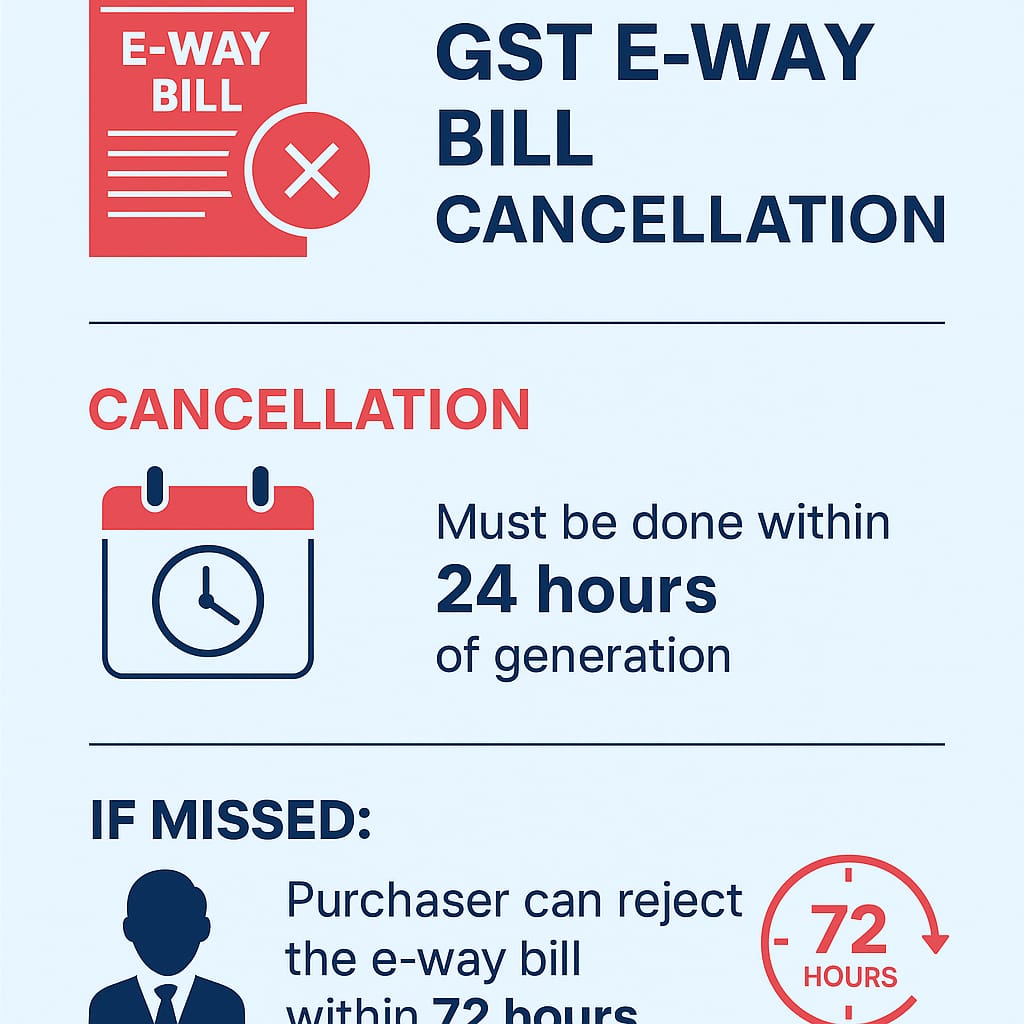

E-Way Bill Cancellation Time Limit: 24 Hours

As per GST rules, you can cancel the e-way bill within 24 hours of generating it. After 24 hours, the system does not allow cancellation online.

Only the person who generated the e-way bill can cancel it. The transporter or recipient cannot do so.

How to Cancel E-Way Bill Online?

You can cancel the e-way bill easily through the GST E-Way Bill Portal:

- Visit ewaybillgst.gov.in

- Log in with your GST credentials.

- Click on ‘E-Way Bill’ > ‘Cancel’.

- Enter the 12-digit e-way bill number.

- Select the reason for cancellation.

- Click ‘Submit’.

Once you cancel the e-way bill, it becomes invalid and you cannot use it again.

What If You Miss the 24-Hour Cancellation Deadline?

If you forget to cancel the e-way bill within 24 hours, you cannot do it through the portal. However, you still have options:

Buyer Can Reject the E-Way Bill within 72 Hours

If the supplier misses the cancellation deadline, the buyer (recipient) has the right to reject the e-way bill within 72 hours of its generation or before its validity expires, whichever comes earlier.

How it works:

The buyer receives an alert when an e-way bill is generated.

If the goods are not received or the transaction is invalid, the buyer can reject the e-way bill using the portal.

This acts as an indirect cancellation and keeps records clean.

Important Points to Remember

- Cancel the e-way bill within 24 hours to avoid confusion.

- If you miss it, ask the buyer to reject it within 72 hours.

- Keep proper records and report in GSTR-1.

- Do not use an invalid or cancelled e-way bill for transport.

Conclusion

Cancelling an e-way bill is a simple process if done on time. If you miss the 24-hour limit, don’t worry — the buyer can still reject it within 72 hours. Make sure to maintain proper GST records, inform your officer if needed, and stay updated with GST compliance to avoid penalties. Understanding these rules will help your business run smoothly and legally.